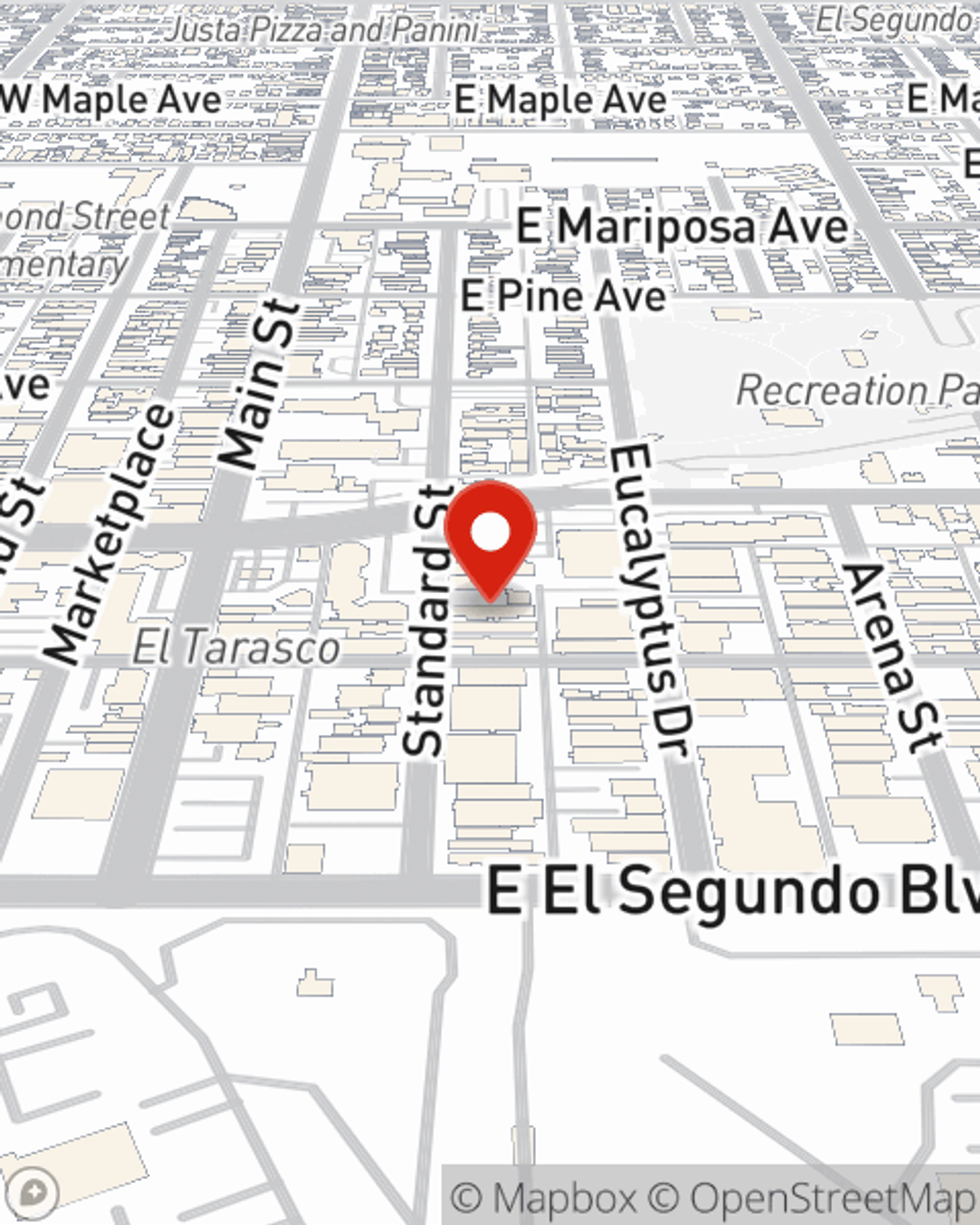

Business Insurance in and around El Segundo

One of the top small business insurance companies in El Segundo, and beyond.

Helping insure small businesses since 1935

- El Segundo

- Manhattan Beach

- Hawthorne

- Redondo Beach

- Inglewood

- Westchester

- Hermosa Beach

- Downey

- Arizona

- Oregon

Help Prepare Your Business For The Unexpected.

As a small business owner, you understand that sometimes the unanticipated does occur. Unfortunately, sometimes catastrophes like a customer stumbling and falling can happen on your business's property.

One of the top small business insurance companies in El Segundo, and beyond.

Helping insure small businesses since 1935

Keep Your Business Secure

With options like business continuity plans, errors and omissions liability, extra liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent Brandon Foster is here to help you personalize your policy and can assist you in submitting a claim when the unexpected does arise.

Take the next step of preparation and visit State Farm agent Brandon Foster's team. They're happy to help you investigate the options that may be right for you and your small business!

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Brandon Foster

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.